Click HERE For information on the methodology and background behind the process of our 4th Quarter Win % over Expectation research.

2024 Results Summary:

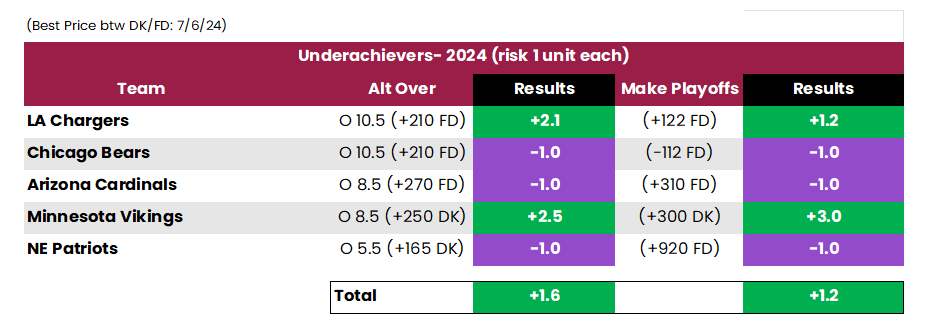

2024 Overachiever Results:

The Following Teams were considered Overachievers by our metric in 2023 heading into the 2024 season:

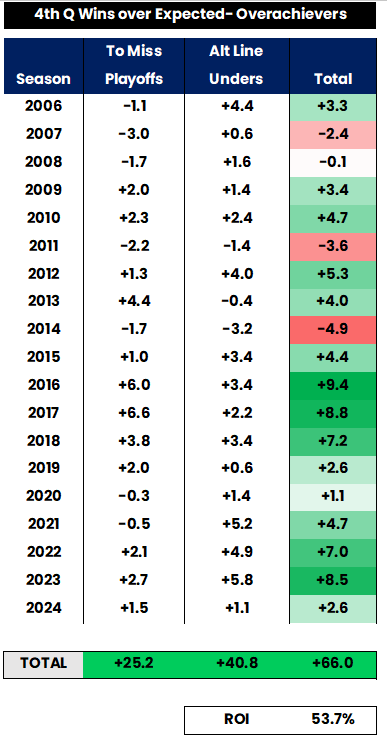

For the 10th straight season and 12 of the last 13, this basket of overachievers delivered positive returns. Only three teams from this basket of seven made the Playoffs and two teams (CIN and NYJ) were decent sized favorites to make the Playoffs and did not. The Jets and Browns were a cakewalk alt under and to miss the Playoffs as they finished with a combined eight wins.

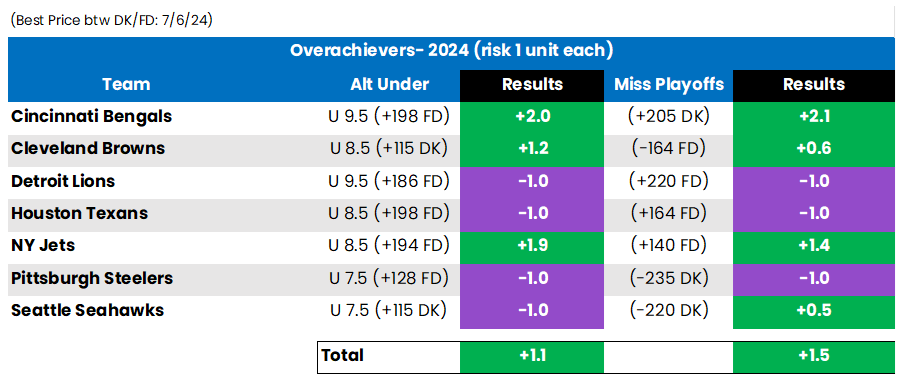

2024 Underachiever Results:

The Following Teams were considered Underachievers by our metric in 2023 heading into 2024:

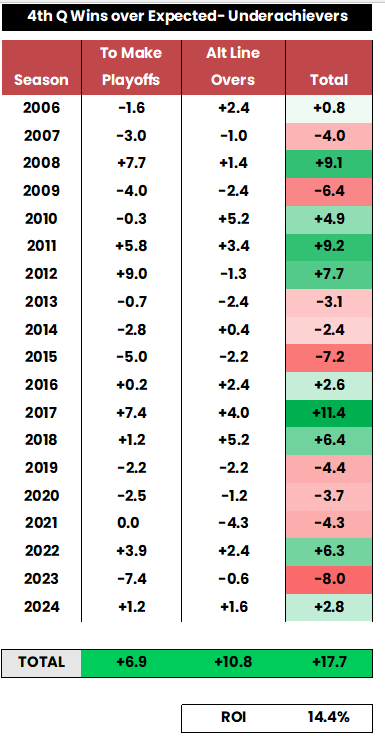

After poor results in 2023, which was the single worst results since we started tracking in 2006, 2024 was back in the positive.